AI Agents forTransform Your Finances Today

AI Agents forTransform

Your Finances

Connect your bank accounts and use AI

to manage debt and maximise savings.

How It Works?

Follow these simple steps for unmatched financial clarity and control.

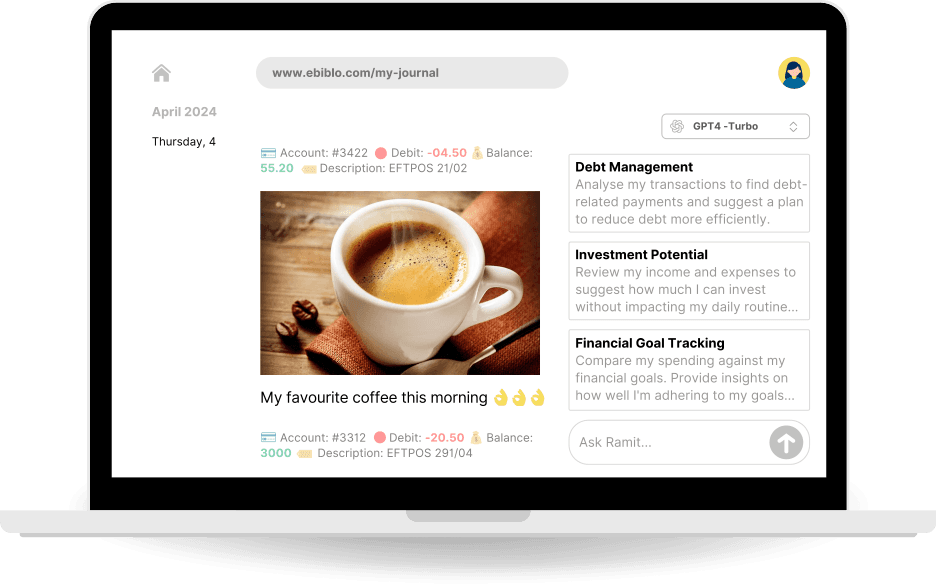

Set up your journal.

Sign up, get the mobile app, and

easily link your bank accounts to

your journal.

Make it personal.

Annotate your transactions and

share your ‘why’ with AI, making

your insights as unique as you.

Get insights on the go.

Receive instant, personalised AI

insights on your transactions

directly on mobile or via email.

Key Benefits

We integrate journaling and banking transactions for a unique user experience.

Journaling + Transactions

Combine the powers of journaling with banking data to track spending, meet savings goals, and boost financial health.

AI-Powered Money Tips

Spending insights enable smarter financial decisions, backed by AI agents trained for personalised savings and debt management.

Data Encryption & Security

Transactions are stored and protected with advanced encryption, ensuring your personal and financial data remains private and secure.

FAQs

Your security is our top priority. We utilise TLS 1.2 encryption for data in transit and AES 256-bit encryption for data at rest in our application, ensuring your financial and personal information remains private and secure.

Our application stands out with its unique blend of personal journaling and AI-powered financial analysis. This approach provides personalised insights, savings opportunities, and debt management strategies, making financial management both accessible and insightful.

The AI in our application analyses your transaction patterns to offer personalised insights into spending habits, savings opportunities, and effective debt management strategies, all designed to help you achieve your financial goals efficiently.

Not at all; once you connect your bank accounts to the application, transactions are automatically synced. You're also able to add personal notes for a richer, more comprehensive financial overview.

Absolutely! You can set and customise your financial goals directly within Ebiblo. Our AI then tailors advice and tracks your progress, keeping you motivated towards your financial aspirations.

Expect to gain insights that help you optimise spending, discover efficient savings techniques, and develop debt management strategies. Our application delivers actionable tips and reminders to help you build better financial habits.

While Ebiblo is not yet available for public sign-up, we invite you to join our mailing list. Subscribe to receive the latest updates, release news, and exclusive insights about our application. Be among the first to explore how Ebiblo can transform your financial management journey.